ACERA Reopening Office to Limited Visitors by Appointment Only

On June 15, ACERA is reopening its office to visitors by appointment only, on Tuesdays and Thursdays.

In order to maintain the health and safety of members and ACERA staff during the ongoing COVID-19 pandemic, ACERA is asking its members to continue completing their business with ACERA via mail, email, phone, or video if they are able.

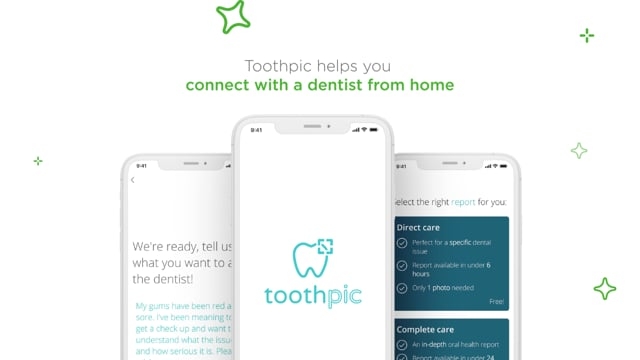

ACERA Retiree Participants in the Delta Dental PPO

Get dental advice from the comfort of your own home!

ACERA 1099-Rs Will Be Mailed in January 2021

Members in retired status, as well as survivors of ACERA members, will receive their 1099-Rs in January. ACERA reports income to payees on IRS form 1099-R. The 1099-R forms for 2020 will be mailed to all payees no later than January 31, 2021. Form 1099-R should be filed with your 2020 tax return.

Get an Electronic Copy After January 18

Your 1099-R form will be available on Web Member Services on January 18, 2021. Log in to take advantage of this great feature.

October Payroll Glitch

Duplicate Payroll Advice

October Payroll Glitch

November 4, 2020

Once a month ACERA processes the monthly payroll. Payments are automatically deposited to member’s accounts monthly through the bank’s ACH electronic depositing system. At ACERA we have internal controls in place to ensure payments aren’t duplicated.

During the October payroll, our banking system experienced a glitch and generated duplicate payment advice to ACERA members.

ACERA’s Office Remains Closed, With Expanded Phone Hours

ACERA’s office remains closed to the public in order to prevent the spread of COVID-19.

Phone Hours: Monday through Friday, 9:00am – 3:00pm

Email Hours: Monday through Friday, 8:30am – 5:00pm send us an email here

Office Hours: Office is closed to visitors

Ready-to-Retire Counseling Appointments: Schedule one here

Explanation of California’s Supreme Court Decision in 2012 “Vested Rights” Lawsuit

On Thursday, the California Supreme Court published a decision in litigation that started in 2012 over changes to the state pension law affecting “legacy members” of ACERA and two other county retirement systems.

Legacy members generally are those who have entry dates into ACERA membership prior to January 1, 2013, which was the effective date of the California Public Employees’ Pension Reform Act (PEPRA). This case relates only to legacy members who retired on or after January 1, 2013.

California’s Supreme Court Published a Decision Today in 2012 “Vested Rights” Lawsuit

The decision has been published by the California Supreme Court in litigation that started in 2012 over changes to the state pension law affecting “legacy members” of ACERA and two other county retirement systems.

Legacy members generally are those who have entry dates into ACERA membership prior to January 1, 2013, which was the effective date of the California Public Employees’ Pension Reform Act (PEPRA). This lawsuit relates only to legacy members who retired on or after January 1, 2013.

Announcing ACERA’s New Website

We are excited to announce ACERA’s new website! We’ve redesigned it so users across all devices will get a similar experience. We’ve also spent a lot of time streamlining information and trying to make things easy to find.

Note: ACERA’s website isn’t supported on Internet Explorer, which is a discontinued web browser. Please use Safari, Firefox, Microsoft Edge, or Google Chrome. Download Chrome for free.

California’s Supreme Court Heard Oral Arguments Today in 2012 “Vested Rights” Lawsuit

On May 5, 2020, California’s Supreme Court heard oral arguments in litigation that started in 2012 over changes to the state pension law affecting “legacy members” of ACERA and two other county retirement systems. Legacy members generally are those who have entry dates into ACERA membership prior to January 1, 2013, which was the effective date of the California Public Employees’ Pension Reform Act (PEPRA). This lawsuit relates only to legacy members who retired on or after January 1, 2013.

New Limited Phone Hours

Due to limited staff resources during the public health order, ACERA is taking calls during the limited hours of 8:30 am – 5 pm Tuesdays and Thursdays only. Outside of those hours, you may leave a voicemail or email us. We will do our best to respond within one business day.

Phone Hours: Tuesday and Thursday, 8:30am – 5:00pm

Email Hours: Monday through Friday, 8:30am – 5:00pm

Office Hours: Office is closed to visitors

Information for Retirees Considering Returning to Work in Critical Positions for Alameda County, Alameda Health System, or Other ACERA Participating Employers

UPDATE 8/18/2021: Governor Newsom has suspended by executive order and until further notice, the restriction on retired annuitants working more than 960 hours per fiscal year for one of ACERA’s participating employers. Please review the current restrictions and duration limits on our Working After Retirement page.

A Message From CEO Dave Nelsen

ACERA Members and Employers,

As the world confronts the spread of the coronavirus (COVID-19), I wanted to update you on how ACERA is responding. I also wanted to address the impact COVID-19 has had on the economy and on ACERA’s investment portfolio—and reassure you that your retirement benefits are safe.

A Message to Members Regarding the Recent Financial Market Activity

Recent events, including the COVID-19 coronavirus outbreak, have caused a downturn in financial markets. ACERA would like to reassure our members that your benefits are secure and are guaranteed by California state law. Your lifetime retirement allowance is not tied to investment returns, but is calculated based upon your years of service and salary. At ACERA, we invest for the long term, and anticipate that our returns may fluctuate from year to year. However, it’s our long term average earnings that drive the funding of the plan.

ACERA Is Monitoring the COVID-19 Coronavirus Situation

ACERA is monitoring the COVID-19 coronavirus situation. Our offices currently remain open, though in order to practice the social distancing that health officials are recommending, we ask you to limit visits to ACERA to only those that are absolutely necessary. We are happy to assist you via phone or email—see below.

We ask that if you are ill and/or have a fever, cough, or shortness of breath, that you reschedule your visit to ACERA. We recommend you stay home, self-quarantine, and contact your healthcare provider for advice and for testing for COVID-19 infection.

March 12 Medicare Transition Seminar Cancelled

The County has issued guidelines for mass gatherings in order to prevent the spread of the COVID-19 coronavirus, and is recommending cancelling small events where possible. As such, ACERA has cancelled the March 12 Medicare Transition Seminar in order to reduce coronavirus risk for our members.

You can view the seminar PowerPoint presentation here:

ACERA Medicare Transition Seminar Presentation

Additionally, ACERA will offer a video recording of the seminar by the end of the week. Check this page for updates.

ACERA 1099-Rs Will Be Mailed in January 2020

Update: 1099-Rs mailed on January 23, 2020.

Members in retired status, as well as survivors of ACERA members, will receive their 1099-Rs in January. ACERA reports income to payees on IRS form 1099-R. The 1099-R forms for 2019 will be mailed to all payees no later than January 31, 2020. Form 1099-R should be filed with your 2019 tax return.

How Your Contribution Rates (and Your Employer’s) Changed For This Year

Each year, ACERA’s actuary calculates the contribution rates that employees and employers must contribute to ACERA’s fund by law in order for us to have enough funds to pay out all the benefits we owe to current retirees, future retirees, and other qualified recipients like beneficiaries.

We’ve received a few questions about contributions recently, so here are some answers to common questions about the retirement fund contributions.