About Investments

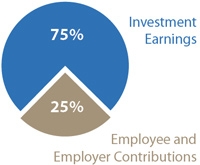

ACERA collects regular contributions for the retirement fund from our members and participating employers, and we invest the fund all over the world. The combination of employee and employer contributions and the earnings from our investments give us the ability to pay our members the retirement benefits that they’ve earned.

Sources of Benefits Funding

Current Investment Portfolio

In order to keep investment risks as low as possible, ACERA invests in a diverse group of investments called “asset classes.” ACERA’s investment team, investment consultants, and the Board of Retirement together strategically determine the portions of the fund to allocate to the classes of assets in order to minimize risk while maximizing return.

Investment Performance

ACERA posts semi-annual public market and private market performance reports, and maintains an archive of performance reports. Performance reports are typically posted with the following schedule:

How We Choose Managers

ACERA is a well-diversified public pension plan with a multi-billion-dollar investment portfolio. Rather than making investments directly, like all pension funds, we work with expert investment managers who handle specific asset classes on our behalf.

Investment Policies

ACERA has established investment policies as protocol to govern how we invest and manage our investments.